For readers seeking insights into shifting investment patterns, this report offers a detailed exploration of the key trends shaping the European Therapeutics sector.

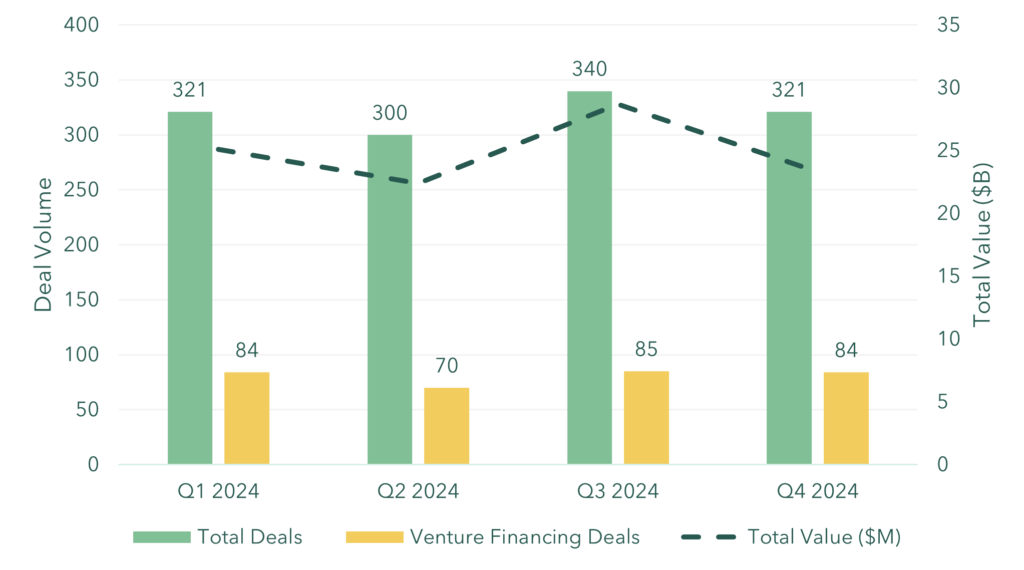

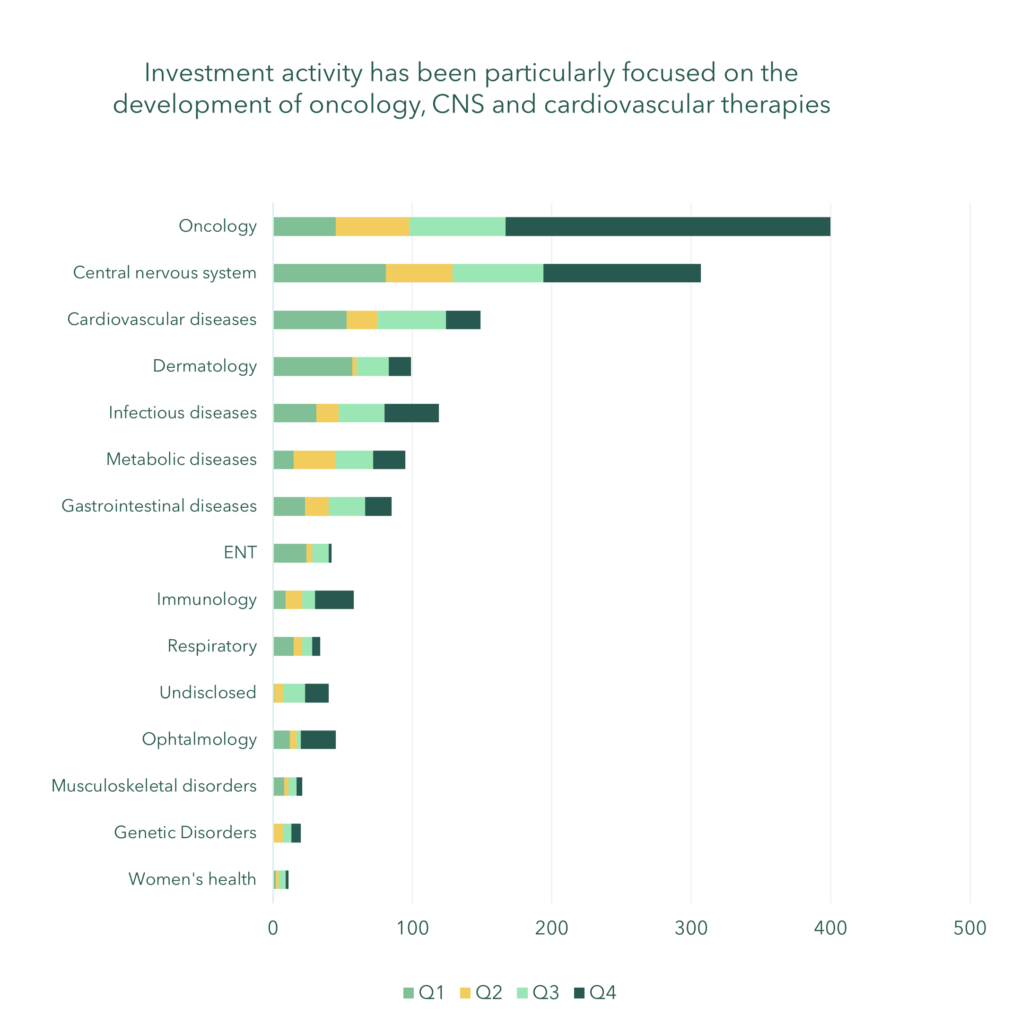

The European Therapeutics sector demonstrated resilience and adaptability throughout 2024, executing 1,282 deals at a total of $99.52 billion. Venture financing accounted for $34.08 billion across 323 deals, highlighting a balanced focus on early-stage innovation and late-stage scalability. Oncology led therapeutic investments with 400 deals, followed by CNS disorders and cardiovascular diseases. Median deal sizes showcased a strategic shift, with significant growth in seed investments and a rebound in growth/later stage funding. This comprehensive analysis underscores the sector’s evolving priorities and sets the stage for sustainable growth in 2025.

Q4 2024: Strategic focus amid adjustments

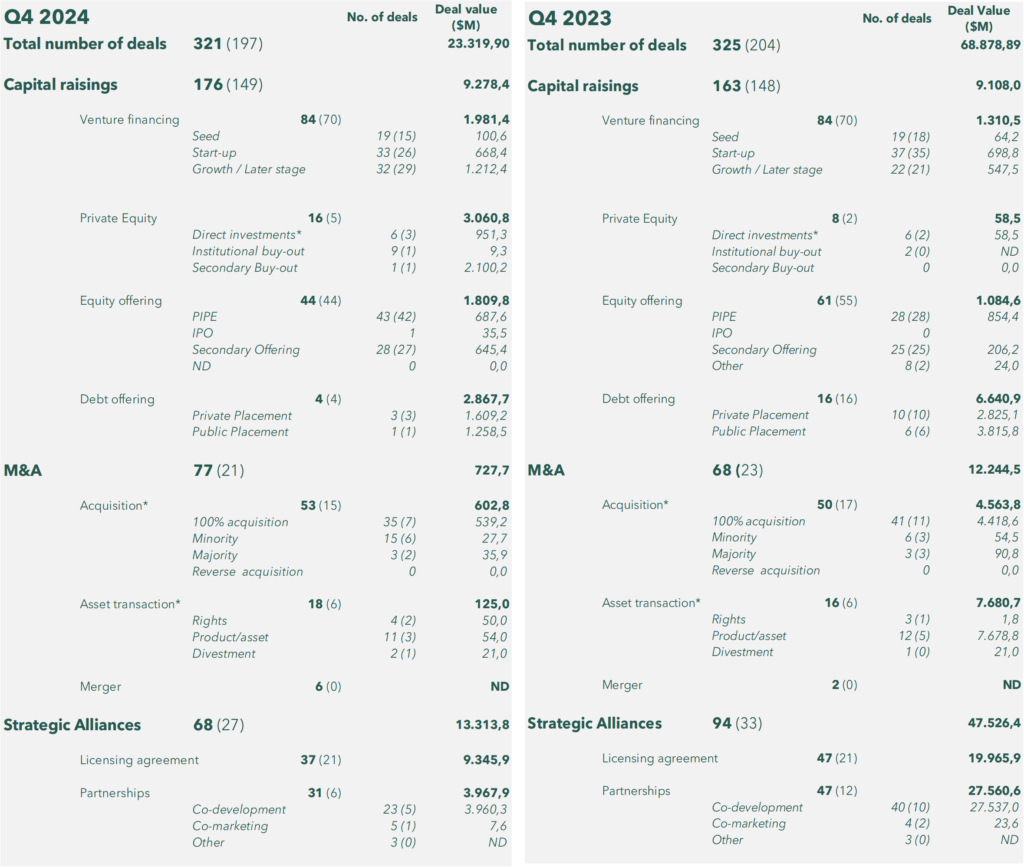

The final quarter of 2024 saw 321 deals, with $23.32 billion deployed. Most deals were closed through capital raisings, driven by growth and later-stage investments, while seed and start-up stages remained stable. Private equity, though limited in deals, delivered impactful investments, including a major secondary buy-out of $2,1B.

Debt offerings and equity placements, while fewer than Q4 2023 (Annex A) , provided vital funding, together contributing nearly $4.7 billion. Notably one IPO this quarter, potentially breaking open the window for biotechs to follow suit. M&A activity remained steady in deal volume but declined significantly in disclosed capital, reflecting fewer high-value acquisitions.

The number of strategic alliances were much lower compared to the same quarter in 2023. Meanwhile, licensing and co-development agreements remained being closed , highlighting continued industry collaborations. These trends reveal a shift from expansive deals in Q4 2023 toward focused investments in scalable later stage innovations in 2024, demonstrating the changing market dynamics in the field.

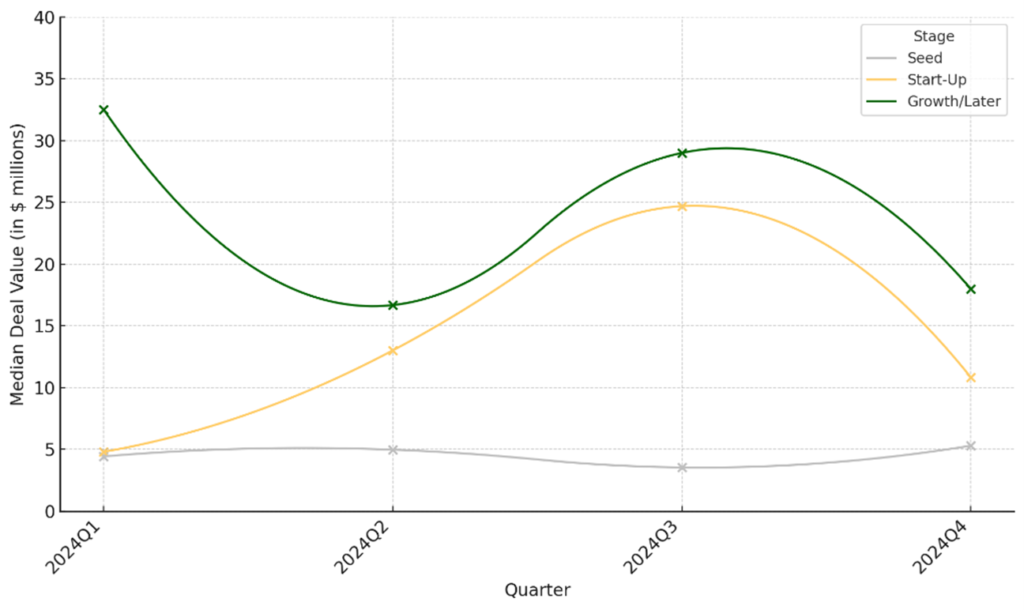

Comparing median deal sizes between Q4 2024 and Q4 2023 highlights subtle but important shifts in investor focus (Figure 2,4). Seed investments experienced a near doubling, with Q4 2024 reporting a median of $5.3 million compared to $2.62 million in the previous year. Start-up stage investments also showed resilience, with a median deal size of $10.84M compared to $8 million the year before. In Q4 2024, median ticket sizes for growthlater-stage reached $17.66 million, a significant increase from $4.9 million in Q4 2023, signalling growing confidence in commercialization-ready ventures.

These differences underscore a strategic pivot in 2024 toward larger commitments in later-stage opportunities, while maintaining steady support for early-stage innovations

The shift reflects an industry that balances immediate market readiness with long-term innovation pipelines.

Therapeutic investments in 2024 (Figure 3) reflected diverse priorities, with oncology leading with 400 deals, bolstered by a sharp rise in Q4. Central nervous system (CNS) conditions followed with 307 deals, including 113 in Q4, driven by advancements in neurological treatments (such as the series B of Noeme Pharma for the further development of basimglurant NOE-101, NOE-105 and NOE-115 across a variety of neurological disorders, including Tourette’s and severe pain in trigeminal neuralgia). Cardiovascular diseases ranked third with 149 deals, reflecting consistent quarterly activity.

Dermatology and infectious diseases saw high engagement, with 99 and 119 deals, respectively, while metabolic and gastrointestinal diseases maintained strong interest, with a total of 95 and 85 deals, respectively. Immunology gained traction in Q4, accounting for nearly half of the yearly total of 58 deals.

Emerging areas like ophthalmology and respiratory diseases recorded 45 and 34 deals, respectively, while musculoskeletal disorders and genetic disorders saw 21 and 20 deals, signalling focused innovation. Women’s health, though smaller in volume, maintained steady engagement with 11 deals across the year.

2024 as a whole

2024 showcased steady activity in the European Biotech and Therapeutics sectors, with a total of 1,282 deals executed, amounting to $99.52 billion in total value. Across all four quarters, venture financing emerged as a consistent driver of investment, contributing $34.08 billion through 323 deals. This highlights the industry’s focus on balancing early innovation and late-stage scalability.

Figure 1 illustrates the total distribution of deals, venture financing deals, and value across quarters. While the total number of deals per quarter remained consistent throughout the year, the total value peaked in Q3 as a result of strategic investments and larger ticket sizes. Venture financing retained steady quarterly contributions, underscoring its critical role in supporting growth and innovation across therapeutic areas.

Median deal sizes in 2024 highlighted notable variations across seed, start-up, and growth/later-stageinvestments, reflecting differing priorities and funding strategies. Growth/later-stage investments consistently captured the largest median deal sizes, averaging $17.66 million by Q4. Start-up stage investments saw median deal sizes stabilize at $10.84 million after a peak close to $25M in Q3, showcasing steady support for scaling companies with proven potential. Seed investments, though lower in absolute value, demonstrated an upward trend, with median sizes reaching $5.3 million in Q4, signalling increased confidence in early-stage innovation.

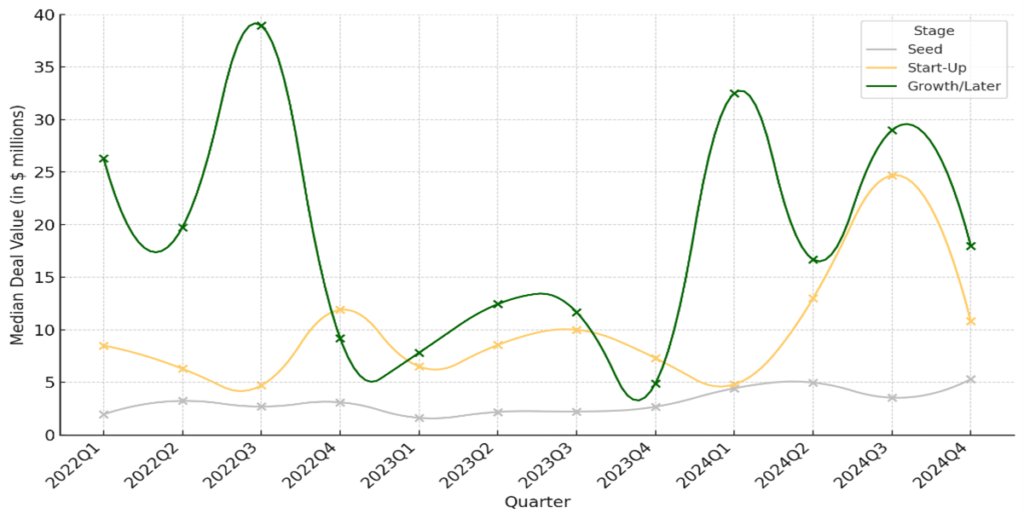

From 2022 to 2024 (Figure 4), median deal sizes evolved to reflect shifting investment priorities. Seed investments grew from $3.2 million in 2022 to $5.3 million in 2024, signaling increased interest in foundational innovation. Start-up investments remained consistent, rising from $10 million in 2022 to $10.84 million in 2024. Growth/later-stage investments experienced fluctuations, peaking at over $35 million in Q3 2a022 and Q1 2024 before stabilizing at $17.66 million in 2024, following a dip in 2023. These trends illustrate a balanced strategy: strong late-stage funding supports scalability, while rising seed investments replenish the innovation pipeline.

Seed stage median tickets showed stability with an end-of-year recovery, whereas start-up tickets showed resilience through Q3 before a significant adjustment in Q4 at $3.71M. Growth/later stage $8.00M exhibited a gradual downward trend throughout the year, starting with larger tickets at ~$15M but ending at a median of $8M.

Outlook for 2025

Heading into 2025, the Therapeutic sectors are well-positioned for growth, with many European funds having raised record-breaking amounts over the past year. As a result, venture financing will likely remain a cornerstone to many fund strategies and Therapeutics companies, fostering both early-stage innovation and late-stage commercialization. Strategic alliances and licensing agreements are expected to facilitate further collaboration, while M&A activity may regain momentum, driven by macroeconomic stability and consolidation opportunities.

Key therapeutic areas, including oncology, CNS disorders, and cardiovascular diseases, alongside emerging fields such as genetic disorders and immunology, will likely remain to shape investment strategies. With stable deal volumes and a focus on scalable innovations, 2025 is set to build on 2024’s recalibrated strategies, driving sustainable growth and innovation.

What does the Venture Finance team at FFUND do?

FFUND’s Venture Finance team helps building and strengthening companies’ propositions to raise capital in an investment round. We do this by offering a number of services: analyzing the companies’ performance through assessment of key indicators, designing the data-room, performing market analyses, company valuations and composing the business plan and teaser deck for investors. On top of that, the team leverages its network of investors to receive feedback on your proposition while serving as a warm introduction.